File a Claim

HDVI makes claims easy and efficient

When accidents happen, our goal is to help you manage a smooth claims process.

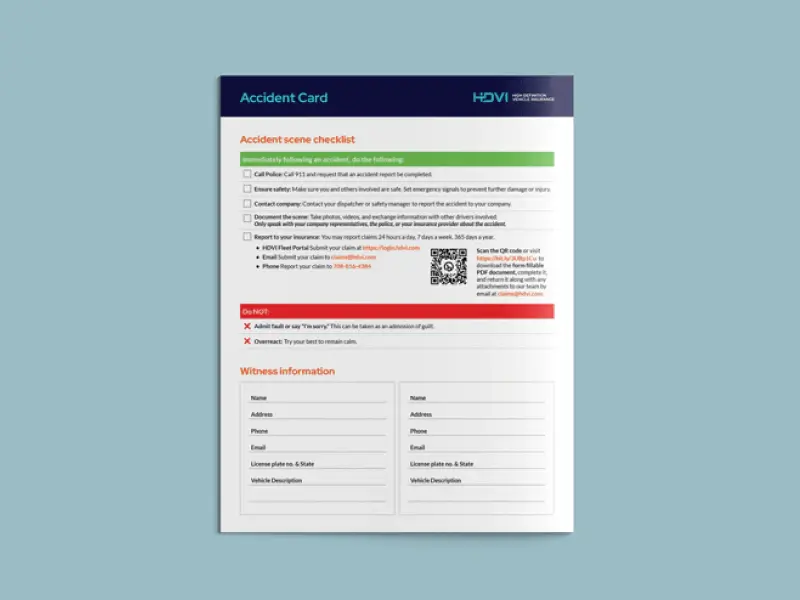

You may report claims 24 hours a day, 7 days a week, 365 days a year.

To report a new claim, choose from the menu below.

-

Submit your claim by Email Complete this form fillable PDF document, download to save it, and return it along with any attachments to our team by email at claims@hdvi.com.

We support you with expert resources that understand trucking so you get the best outcome as quickly as possible

- 24/7 claims reporting

- Experienced trucking adjusters

- Claims number provided to customers same day when reported within business hours

- Faster resolution of claims

- Direct access to U.S.-based support team and constant contact with assigned claims professional

- Emergency response team at point of accident and available for post-incident fact gathering

- Quick access to telematics data and video and knowledge of customers' operations from HDVI fleet services team

Meet our team of trucking claims experts

Janice Hayne

Director of Claims

Michael Spencer

Property Damage Claims Manager

Benjamin Howley

Claims Operations Analyst

Erica Russell

Senior Liability Adjuster

Stephen Harrison

Liability Adjuster

Holly Owen

Physical Damage Adjuster

Charlie Craig

Physical Damage Adjuster

Genesia Robinson

Physical Damage Adjuster

Jason Huhl

Physical Damage Adjuster

Jeff Boehm

Liability Manager

FAQs about claims

When should I submit a claim?

Every incident, regardless of fault or magnitude, should be promptly reported. This will enable HDVI to provide you the best protection and claim services available.

How does a claim impact my insurance premium?

Many factors are reviewed when determining rates, and claims history is a part of that evaluation. HDVI reviews each incident to determine if there was a fault and to what degree. It is far worse to have late reported claims than to have a promptly reported incident.

Do I get a claims advocate from HDVI?

Yes! HDVI is committed to providing the best in class Claims service and support. You have a direct contact at HDVI to help you through the claims process and address your questions and concerns.

What information do I need to report a claim?

To report a claim, you'll need to provide a basic description of what happened and where it occurred. Additional information and documentation can be gathered and provided later as requested by the claims adjustor.

What are the risks of not reporting claims promptly or not reporting them at all?

Not reporting claims promptly or at all can lead to increased claims costs, loss of evidence, reduced credibility of witness and driver statements, legal complications, and potentially higher insurance premiums.

How can technology improve the claims investigation process?

Technology, such as dash cams, telematics data, GPS tracking, electronic logging devices (ELDs), and advanced analytics, can streamline the claims investigation process by providing accurate and timely evidence and data, leading to faster and more efficient claims resolutions. Securing this data immediately following an accident should be a top priority.

What if the incident seems minor or I believe my company is not at fault?

Even if an incident appears minor or you believe that your company is not at fault, it's essential to report the claim immediately. Minor incidents can sometimes escalate into larger claims, and initial assumptions about fault may change upon further investigation. Prompt reporting allows your insurance company to investigate on your behalf and protect your interests.

How can I ensure my trucking company follows best practices for claims reporting?

Establish a clear and concise claims reporting procedure within your company, educate your employees on the importance of prompt claims reporting, and encourage the use of technology to gather and preserve evidence. Regularly review and update your procedures to ensure continued adherence to best practices.

What should I do if I suspect insurance fraud?

Each year, billions of dollars are lost to insurance fraud. You lose money too, when fraud raises your insurance rates. If you become aware of insurance fraud, call 1-833-401-0002 or visit http://www.lighthouse-services.com/hdvi to report it. You can anonymously report suspected fraud and keep your insurance premiums from going up.

Learn more on our Fight Fraud page.